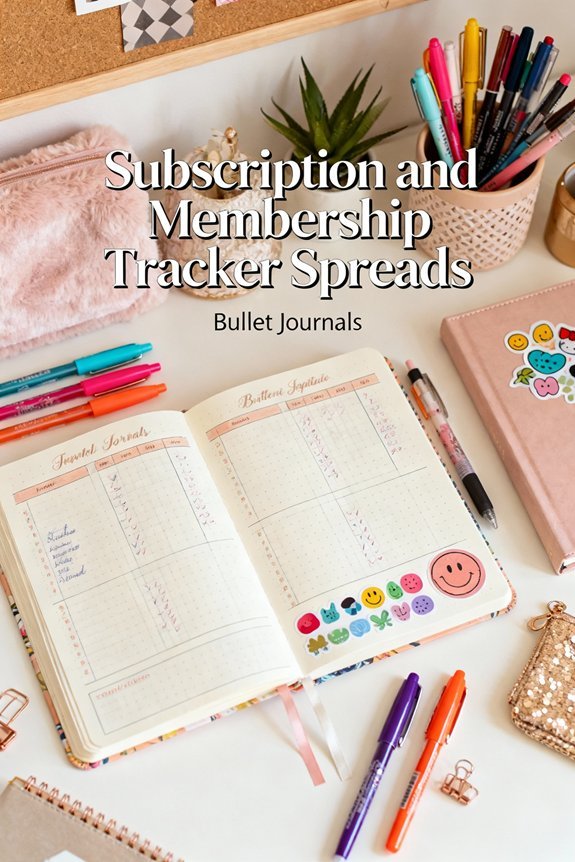

You'll want to document renewal dates, login credentials, and cancellation policies for each subscription in your tracker. Create dedicated columns for service name, amount, billing date, and payment method, then assign color codes to categories like entertainment (red) or productivity (blue) for instant recognition. Set up automated alerts 3-7 days before renewals through Google Calendar or phone notifications, and establish monthly reviews to catch overlooked charges. By adding cost comparison columns between monthly and annual plans, you'll identify savings opportunities and underused services that deserve cancellation—the following sections break down exactly how to structure this system.

Key Takeaways

- Track renewal dates, login credentials, trial periods, and cancellation policies to avoid unexpected charges and maintain organized access to all subscriptions.

- Display both monthly and annual costs side-by-side to calculate potential savings, typically 15-30% when choosing yearly plans over monthly payments.

- Apply color coding by category (entertainment, productivity, fitness, education) for instant visual recognition and spending pattern identification across your tracker.

- Set up multiple payment reminders using calendar alerts, SMS notifications, and app-based systems 3-7 days before renewal dates to prevent missed payments.

- Conduct monthly charge reviews, quarterly usage assessments, and annual spending analyses to identify underused subscriptions and consolidation opportunities.

Essential Information to Track for Each Subscription

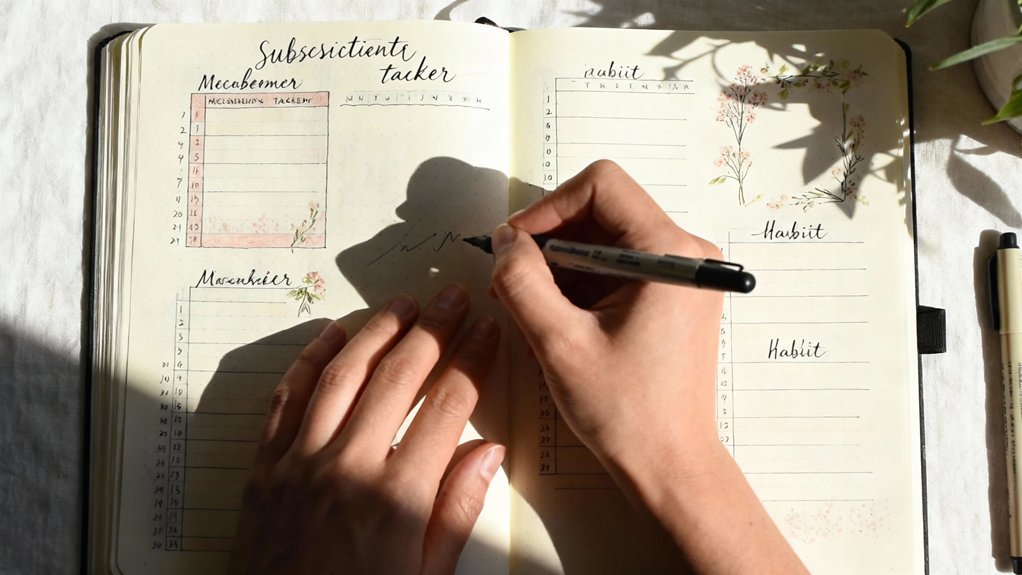

Document renewal dates and auto-renewal status to prevent unexpected charges. Record login credentials or reference numbers for quick access.

Track renewal dates and auto-renewal settings carefully—forgotten subscriptions drain budgets faster than services you consciously choose to keep.

Include trial periods with end dates—you'll avoid converting to paid memberships unintentionally.

Cancellation policies deserve dedicated space in your tracker. Note the required notice period, termination process, and any associated fees. Some services demand 30-day advance notice or impose early termination penalties that'll impact your budget.

Add category tags (streaming, software, fitness) to identify spending patterns. Track usage frequency—services you're not actively using become obvious candidates for elimination.

Include customer support contact information for efficient account management when modifications become necessary.

Monthly vs. Annual Subscription Layout Options

You'll need to decide how to display your subscription costs—by monthly payments or annual totals.

Create visual tracking elements that show your recurring monthly charges alongside comparison charts that calculate yearly expenses.

This dual-view approach lets you identify which payment structure saves you money and helps you spot subscriptions that drain your budget over time.

Monthly Payment Visual Tracking

Most subscription trackers display payment schedules in one of two fundamental layouts: a monthly grid view or an annual calendar view. Your monthly grid creates visual accountability by mapping each service's payment frequency across a 30-day span.

You'll identify clustering patterns—multiple charges hitting simultaneously—enabling proactive cash flow management. Color-code by category: entertainment, productivity, health.

Your annual view reveals long-term commitment costs and renewal dates at a glance, preventing auto-renewals you've forgotten. These tracking tools change abstract recurring charges into tangible visual data.

Design dedicated columns for service name, amount, billing date, and payment method. Add status indicators—active, paused, cancelled—to maintain current accuracy.

This simple method converts passive spending into active financial intelligence, strengthening subscription optimization decisions based on concrete visual evidence.

Annual Cost Comparison Charts

Annual subscription plans typically cost 15-30% less than their monthly equivalents, yet this savings remains hidden without direct comparison visualization.

You'll need side-by-side columns displaying monthly versus annual cost breakdowns for each service. Calculate the annual cost by multiplying monthly fees by twelve, then position this against the prepaid annual rate.

Add a third column showing absolute dollar savings and percentage differences.

Color-code your comparison benefits—green for annual savings exceeding 20%, yellow for 10-20%, and red for minimal differences. This visual hierarchy instantly reveals which subscriptions warrant switching to annual billing.

Include a cumulative total row at the bottom, demonstrating your potential yearly savings across all subscriptions. This simple method alters abstract pricing into actionable financial intelligence, enabling data-driven decisions about payment frequency optimization.

Color Coding Systems for Different Service Categories

Visual organization changes a cluttered subscription list into a scannable system you can understand at a glance. Color coding benefits your tracker by enabling instant recognition of spending patterns across different service categories. You'll process information faster when each category has its designated hue.

Assign specific colors to service category examples like entertainment (red), productivity tools (blue), health and fitness (green), and education (purple). Streaming services such as Netflix and Spotify share entertainment's red coding, while Grammarly and Notion receive productivity's blue. This simple method reveals where your money concentrates.

You can customize categories based on your subscription portfolio. Add orange for food delivery, yellow for cloud storage, or teal for creative software. The key is maintaining consistency—once you've assigned colors, stick with them across all tracking pages.

This visual hierarchy alters data interpretation from a tedious task into an immediate comprehension experience. Experimenting with journaling layouts helps you discover which color-coding systems work best for your personal tracking style and preferences.

Adding Cost Analysis and Budgeting Sections

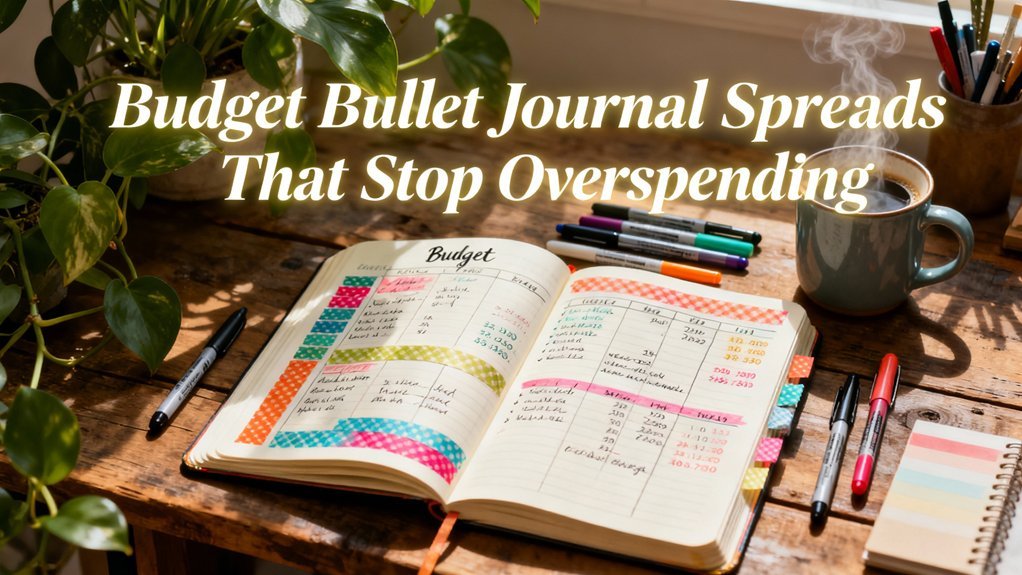

Once you've organized your subscriptions by category, alter that data into actionable financial insights through dedicated cost analysis sections.

Design a cost breakdown module that calculates monthly, quarterly, and annual expenditures automatically. This visual representation reveals spending patterns you might otherwise overlook.

try budget forecasting tools that project future expenses based on renewal dates and payment cycles. Create comparison charts showing actual spending against predetermined limits, enabling real-time adjustments before overspending occurs.

Structure your analysis section with these components: total monthly obligations, year-over-year trends, and category-specific allocations.

Add conditional formatting that highlights when you're approaching budget thresholds, triggering proactive decision-making.

Include a projection timeline that maps upcoming charges across the next twelve months. This forward-looking approach changes your tracker from a passive record into an energetic financial management system that anticipates needs and prevents budget surprises.

Setting Up Payment Reminder Systems

You'll need reliable systems to guarantee you never miss a payment deadline for your subscriptions.

Visual cue methods like calendar color-coding and physical sticky notes provide immediate, tangible reminders of upcoming charges.

Automated digital alerts through apps, email notifications, and banking tools create backup layers that trigger warnings before money leaves your account.

Visual Cue Methods

Sticky notes on your bathroom mirror, calendar alerts on your phone, and color-coded dashboard widgets all serve the same purpose: they convert invisible payment deadlines into impossible-to-ignore visual triggers.

Deploy these three strategic visual cue methods:

- Icon-Based Systems: Assign unique visual symbols to each subscription category (streaming = play button, fitness = dumbbell, software = gear). Your brain processes images 60,000 times faster than text.

- Color Hierarchy Framework: try tracking colors that signal urgency—green for paid, yellow for upcoming (7 days), red for overdue. This eliminates guesswork.

- Physical Placement Strategy: Position visual reminders in high-traffic zones where you make financial decisions: workspace desk, wallet, laptop screen edge.

Transform passive awareness into active management through deliberate visual architecture that demands response rather than requesting attention.

Automated Digital Alerts

While visual cues create immediate awareness, they require you to be present and looking. Automated reminders eliminate this dependency by delivering subscription alerts directly to your devices. Configure these systems to notify you 3-7 days before renewal dates, ensuring adequate response time.

| Alert Type | Best Timing | Platform |

|---|---|---|

| Email notifications | 7 days before | Gmail filters |

| Push alerts | 3 days before | IFTTT/Zapier |

| Calendar reminders | 5 days before | Google Calendar |

| SMS messages | 2 days before | Twilio integration |

| Slack notifications | 1 day before | Webhook setup |

Stack multiple alert methods for critical subscriptions. Test your automated reminders monthly to verify functionality. Link alerts to your tracker spreadsheet using URL references, creating a smooth feedback loop between passive monitoring and active intervention.

Creating a Subscription Audit Schedule

Since subscriptions can multiply quickly and renewal dates rarely align, establishing a regular audit schedule prevents overlooked charges and wasted spending. Your tracking system becomes truly effective when you systematically review it according to subscription frequency patterns.

Regular subscription audits transform passive tracking into active financial management, preventing overlooked charges and maximizing value from your digital spending.

try these three audit intervals to maintain control:

- Monthly reviews – Scan all active subscriptions, verify recent charges match your records, and flag any billing discrepancies or unwanted renewals.

- Quarterly assessments – Evaluate actual usage against cost for each service. Cancel underused subscriptions and identify consolidation opportunities across similar platforms.

- Annual in-depth analyses – Analyze spending trends, renegotiate rates with providers, and realign your subscription portfolio with current priorities and goals.

Mark these audit sessions directly in your tracker alongside renewal dates. This structured approach changes passive record-keeping into active financial management, ensuring every subscription continuously justifies its place in your budget while driving maximum value from your digital ecosystem.

Digital Tools vs. Analog Tracking Methods

Your choice between digital platforms and paper-based systems fundamentally shapes how effectively you'll maintain subscription oversight.

Digital organization offers automated renewal alerts, cloud synchronization across devices, and real-time cost calculations that adapt as you update entries. You'll benefit from instant search capabilities and data backup that prevents information loss.

Paper planners provide tactile engagement that strengthens memory retention and eliminates screen fatigue. You're not dependent on battery life, internet connectivity, or software updates. The physical act of writing creates cognitive anchoring that digital inputs often lack, a principle central to the Bullet Journal Method which emphasizes how writing transforms thinking and reconnects you with what truly matters.

Consider hybrid approaches that use both methods' strengths. Use digital tools for automated tracking and analytics while maintaining paper planners for quarterly reviews and strategic planning sessions. This combination accommodates different thinking modes and guarantees redundancy.

Your ideal system aligns with your cognitive preferences, technical proficiency, and lifestyle patterns.

Test both approaches through thirty-day trials before committing to either methodology.

Frequently Asked Questions

How Do I Track Free Trials Before They Convert to Paid Subscriptions?

You'll need dedicated columns for free trial reminders and tracking expiration dates in your spread.

Create fields for trial start date, trial length, and auto-calculated end dates.

Set up visual alerts—like color coding—that flag trials ending within 3-7 days.

Include a cancellation deadline column since some services require notice before auto-renewal.

Add checkboxes to mark whether you've decided to keep or cancel each service, streamlining your decision-making process before charges hit.

What Should I Do With Subscriptions I Share With Family Members?

Studies show households waste 42% less on subscriptions when they track shared accounts.

Create a dedicated “Shared Subscriptions” section noting who's access and each person's cost splitting percentage. Document payment responsibility, billing dates, and renewal terms.

Tag these entries distinctly from personal subscriptions. Track shared usage patterns to enhance your family's collective spending.

This simple method guarantees you're maximizing value while maintaining clear accountability across all users who benefit from the service.

Can I Track Subscriptions That Have Variable Monthly Costs?

You'll effectively track subscriptions with variable costs by creating a dedicated column for fluctuating amounts.

Record each month's actual charge, then calculate a rolling three-month average to anticipate future expenses. This approach enables proactive budget adjustments rather than reactive scrambling.

Set up conditional formatting to highlight significant deviations from your baseline.

You're building an adaptable system that adjusts to your spending patterns, ensuring you'll maintain financial clarity despite unpredictable charges.

How Do I Handle Seasonal Subscriptions That Pause During Certain Months?

You'll want to create a dedicated status column with “Active” and “Paused” flags to track seasonal pause strategies.

Set up conditional formatting to highlight paused subscriptions, and add a “Resume Date” field for when they'll reactivate.

Configure subscription renewal reminders 30 days before the resume date so you're prepared.

Consider adding a notes section documenting pause patterns—this data helps you enhance future budgeting and identify which services you're actually using year-round.

Should I Track Subscriptions Paid Through Gift Cards or Prepaid Balances?

“Don't put all your eggs in one basket”—yes, track subscriptions funded by gift cards or prepaid balances.

Create a separate column for gift card usage to monitor remaining credit and expiration dates.

try prepaid balance management by logging initial amounts, deduction rates, and renewal thresholds.

You'll anticipate when balances deplete and prevent service interruptions.

This simple method changes passive tracking into proactive financial oversight, ensuring you're never caught off-guard when your prepaid funds run dry.

Conclusion

You've now got the framework—but here's what separates subscription chaos from true control. Your tracker isn't just a pretty spread; it's your financial guardian. Start with one section tonight. Fill in three subscriptions tomorrow. By week's end, you'll uncover forgotten charges draining your account. The question isn't whether you'll find savings—it's how much you'll recover. Your wallet's waiting. Will you take action, or let another month slip by?

Subscription Tracking Supplies

Disclosure: Affiliate links. We earn from qualifying purchases.

Track all your subscriptions.

Related Resources

- Beginner's Guide to Bullet Journaling

- Bullet Journaling for ADHD

- Browse All Spreads

- Browse All Trackers

- Free Templates