Why Track Your Budget in a Bullet Journal

Digital budgeting apps are convenient, but there is something powerful about writing down your finances by hand. The act of physically logging expenses creates awareness that tapping a screen cannot replicate. You become more intentional with every purchase when you know you will write it down later.

A bullet journal budget system gives you complete control over how you track your money. No subscriptions, no data privacy concerns, and a format that matches exactly how your brain works with money.

Essential Budget Spreads to Include

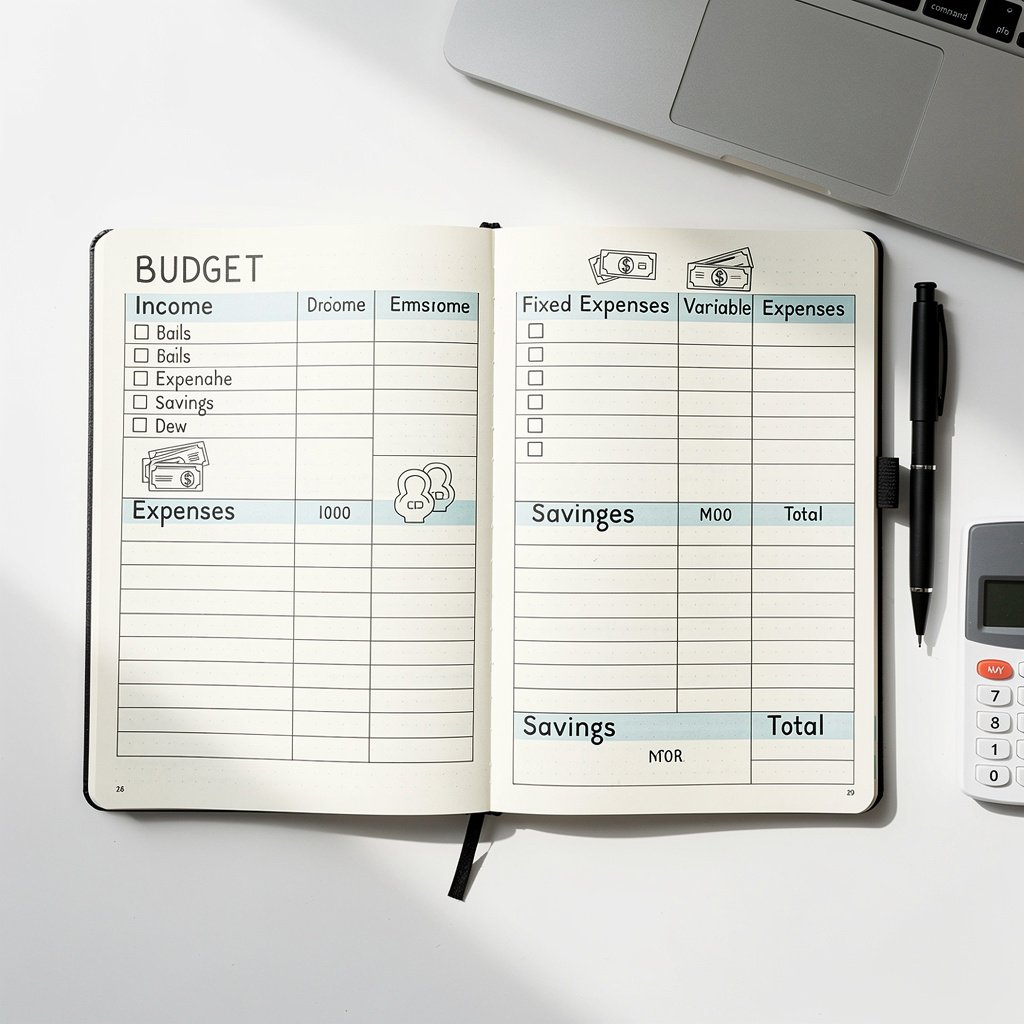

1. Monthly Budget Overview

Start each month with a clear picture of your finances. This single spread shows income, fixed expenses, variable expenses, and savings goals at a glance.

What to include:

- Expected income (all sources)

- Fixed expenses (rent, subscriptions, loan payments)

- Variable expense categories (groceries, gas, entertainment)

- Savings goals for the month

- Actual vs. planned tracking columns

2. Daily Expense Tracker

Log every purchase as it happens. Keep this spread open throughout the month and jot down each expense with the date, description, category, and amount.

Sample columns:

- Date

- Description (what you bought)

- Category (food, transport, fun, etc.)

- Amount

- Payment method (optional)

3. Bill Payment Tracker

Never miss a bill again. Create a spread that lists all recurring bills with due dates. Check them off as you pay throughout the month.

Include:

- Bill name

- Due date

- Amount

- 12 monthly columns to check off payments

4. Savings Goal Tracker

Visualize your progress toward savings goals. Whether saving for an emergency fund, vacation, or major purchase, watching the tracker fill up is deeply motivating.

Popular formats:

- Thermometer style (fill as you save)

- Grid boxes (color in each $50 or $100 saved)

- Bar chart showing progress by month

5. Debt Payoff Tracker

If you are paying off debt, create a dedicated spread to track your progress. Seeing debt decrease month by month provides powerful motivation to keep going.

What to track:

- Starting balance

- Current balance

- Monthly payments

- Interest saved

- Projected payoff date

How to Set Up Your Budget System

Step 1: Know Your Numbers

Before creating any spreads, gather your financial information:

- Monthly income (after taxes)

- List of all fixed monthly expenses

- Average spending in variable categories (review past bank statements)

- Current savings and debt balances

Step 2: Choose Your Tracking Method

Decide how detailed you want to be:

- Simple: Track totals by category weekly

- Moderate: Log individual expenses daily

- Detailed: Track every transaction with notes

Start simple. You can always add more detail once the habit is established.

Step 3: Create Your Core Spreads

At minimum, set up:

- Monthly budget overview (beginning of each month)

- Expense tracking pages (daily or weekly)

- One savings or debt goal tracker

Step 4: Review Weekly

Set aside 15 minutes each week to review your spending. Are you on track? Where are you overspending? Adjust your behavior while there is still time left in the month.

Budget Tracking Tips

Use Color Coding

Assign colors to spending categories. Green for necessities, blue for bills, red for wants, yellow for savings. This makes patterns visible at a glance.

Round Up

For faster logging, round expenses to the nearest dollar. The slight inaccuracy is worth the ease of tracking.

Track Cash Separately

Cash spending is easy to lose track of. Create a specific section for cash expenses or use the envelope method alongside your journal.

Include a No-Spend Challenge

Mark days when you spend nothing. Try to string together no-spend days and celebrate the streaks.

Reflect Monthly

At month end, review what went well and what needs adjustment. Write a few sentences about your financial wins and lessons learned.

Common Budget Tracking Mistakes

- Making it too complicated: Start simple. A complex system you abandon is worse than a basic one you maintain.

- Forgetting to log: Set a daily reminder to update your expense tracker. Just 2 minutes keeps you on track.

- Unrealistic budgets: Base your budget on actual past spending, not wishful thinking.

- No fun money: Budget for entertainment and treats. Deprivation leads to budget blowouts.

- Giving up after overspending: One bad week does not ruin the month. Reset and keep tracking.

Sample Monthly Budget Template

Here is a simple framework to adapt for your own journal:

MONTH: ___________ INCOME Paycheck 1: $_______ Paycheck 2: $_______ Other: $_______ TOTAL: $_______ FIXED EXPENSES Rent/Mortgage: $_______ Utilities: $_______ Insurance: $_______ Subscriptions: $_______ TOTAL FIXED: $_______ VARIABLE BUDGET Groceries: $_______ Gas/Transport: $_______ Dining Out: $_______ Entertainment: $_______ Personal: $_______ TOTAL VARIABLE: $_______ SAVINGS Emergency Fund: $_______ [Goal Name]: $_______ TOTAL SAVINGS: $_______ REMAINING: $_______

Taking It Further

Once you have mastered basic budget tracking, consider adding:

- Net worth tracker (quarterly updates)

- Subscription audit spread

- Spending triggers journal

- Financial goals vision page

- Annual money review spread

Your financial bullet journal grows with you. Start with the basics and add complexity as your money management skills develop.

Related Resources

- Start Here – New to bullet journaling? Begin here

- Tracker Library – More tracking ideas

- Spreads Library – Layout inspiration

- Supplies Guide – Get the right tools