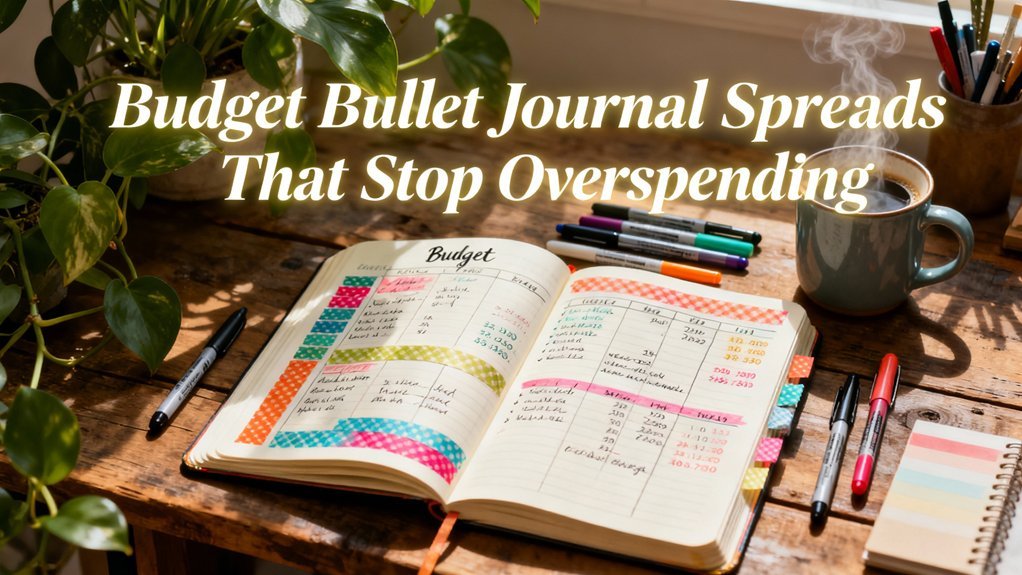

You'll stop overspending when you track money in real-time, not after it's gone. Create a Monthly Money Dashboard that logs income, expenses, and savings targets on one page. Add a Weekly Expense Tracker with daily entries and cumulative totals to catch spending leaks within three days. Include a No-Spend Challenge Tracker with daily success boxes and temptation logs. Pair these with a Daily Spending Log that captures timestamps, categories, and payment methods—transforming unconscious purchases into deliberate choices that reveal exactly where your money disappears.

Key Takeaways

- Monthly Money Dashboard consolidates income, expenses, and savings into one visual command center for real-time budget monitoring.

- Weekly Expense Tracker captures daily spending patterns and reveals behavioral trends that monthly summaries often miss.

- Category-Based Budget Breakdown assigns specific dollar limits to spending categories with color-coded progress indicators to prevent overspending.

- No-Spend Challenge Tracker logs daily successes, temptation resistance strategies, and calculates accumulated savings from avoided purchases.

- Daily Spending Log transforms unconscious spending into deliberate choices by tracking timestamps, categories, payment methods, and identifying spending leaks.

The Monthly Money Dashboard Spread

The Monthly Money Dashboard Spread alters scattered financial data into a single-page command center that tracks your income, expenses, and savings goals at a glance.

Transform financial chaos into clarity—one dashboard page replaces dozens of spreadsheets, receipts, and mental calculations cluttering your money management system.

You'll structure this spread into four strategic zones. First, log your monthly income sources with exact figures—salary, side hustles, passive revenue streams.

Second, create category-based expense trackers using visual meters or progress bars that fill as you spend.

Third, establish a savings allocation section with percentage targets for emergency funds, investments, and goal-specific accounts.

The fourth zone reinvents your financial control: a rapid-response budget adjustments panel. Here, you'll document real-time spending deviations and try corrective measures immediately.

Track variance percentages, identify patterns, and execute micro-pivots throughout the month.

This dashboard eliminates the lag between spending and awareness. You're no longer reconciling last month's mistakes—you're optimizing current transactions.

The systematic practice of writing and reflection in your dashboard transforms how you process financial thoughts and approach money decisions, building the clarity and focus that prevents impulsive overspending.

Update it weekly for maximum effectiveness, altering reactive budgeting into proactive financial engineering.

Weekly Expense Tracker That Shows Real-Time Spending Patterns

While monthly dashboards provide strategic oversight, weekly expense trackers deliver the tactical precision needed to identify spending patterns before they derail your budget. This spread captures real-time trends as they emerge, allowing you to course-correct immediately rather than discovering overspending weeks later.

Structure your weekly tracker with daily expense entries that categorize each transaction. This granular approach reveals spending habits that monthly views often obscure—like your Tuesday coffee shop routine or Friday takeout pattern.

| Day | Category | Amount |

|---|---|---|

| Monday | Food | $24.50 |

| Tuesday | Transport | $18.00 |

| Wednesday | Shopping | $67.20 |

Track cumulative totals alongside daily entries to visualize your weekly burn rate. Add visual indicators—colored dots or symbols—to flag discretionary versus essential purchases. This data-driven method alters abstract spending into actionable intelligence, enabling you to adjust behavior mid-week when it matters most. Mastering these time management techniques through your bullet journal transforms scattered financial data into purposeful spending decisions that align with your long-term goals.

The No-Spend Challenge Tracker Layout

Your tracker should capture:

- Challenge duration parameters: Mark start/end dates with daily boxes to check off successful days.

- Temptation incidents: Log each urge with timestamp, trigger context, and resistance strategy deployed.

- Savings accumulation: Calculate running totals of money not spent versus baseline spending patterns.

- Category-specific streaks: Track consecutive days avoiding specific spending categories (dining out, impulse purchases, entertainment).

- Milestone rewards system: Pre-define non-monetary rewards at 7, 14, and 30-day intervals.

Monitor challenge progress through completion percentages and trend analysis.

Track your no-spend journey with data-driven metrics that transform daily victories into measurable behavioral patterns and long-term financial success.

When you spot recurring temptation triggers, you'll try preventive protocols.

This simple method changes abstract willpower into quantifiable achievements that reinforce sustained behavioral modification.

Bill Payment Calendar Spread to Avoid Late Fees

Late fees drain $50-100 annually from the average household budget, yet they're completely preventable with a structured tracking system. Your bill payment calendar spread alters chaos into clarity through visual organization.

Design a monthly grid showing each bill's due date, amount, and payment status. Color-code by category: utilities in blue, subscriptions in green, loans in red. This instant visual reference eliminates forgotten deadlines.

Add payment reminders five days before each due date. Set up a checkbox system tracking three stages: bill received, payment scheduled, payment confirmed. This triple-verification approach guarantees late fee prevention through redundant safeguards.

Include a running tally of money saved from avoided penalties. Watching this number grow reinforces positive financial behavior and motivates consistent tracking.

Position your spread where you'll see it daily. Integrate weekly review sessions into your routine, updating payment statuses and preparing for upcoming bills. This proactive system shifts reactive scrambling into strategic control.

Cash Envelope System on Paper

The cash envelope budgeting method delivers a 23% reduction in overspending compared to card-only budgeting, according to financial behavior studies.

You'll replicate this proven system in your bullet journal without managing physical envelopes. Create dedicated pages for each spending category with running balance trackers. At month start, allocate your budget amounts and subtract each transaction immediately. This visual representation triggers the same spending awareness that physical cash provides.

Essential components for your paper envelope system:

- Category headers with allocated amounts and date ranges

- Transaction logs with vendor, date, and amount columns

- Running balance calculations to track remaining funds

- Color-coded warning zones when approaching limits

- Monthly reflection space to analyze spending patterns

The budgeting benefits extend beyond overspending prevention. You'll identify spending triggers, enhance category allocations, and build financial discipline through consistent tracking.

This goal-oriented approach alters abstract numbers into practical insights that drive sustainable behavioral change.

Savings Goals Thermometer Spreads

Visual progress tracking increases savings completion rates by 42% compared to spreadsheet-only methods, as demonstrated in behavioral economics research. Thermometer spreads convert abstract numbers into tangible achievements through savings visualization that activates your brain's reward pathways.

Design your thermometer with precise increments matching your target amount. You'll color sections as you deposit funds, creating immediate visual feedback that reinforces saving behaviors. This goal tracking method works because you're engaging multiple cognitive processes simultaneously—visual, motor, and analytical.

Scale your thermometers vertically along page margins to monitor multiple objectives concurrently. Label each with specific metrics: emergency fund milestones, vacation budgets, or debt payoff targets. Update weekly using distinct colors that represent different funding sources.

The psychological impact compounds when you see accumulated progress. Each filled section triggers dopamine release, strengthening your commitment to financial objectives.

You're not just tracking numbers—you're engineering behavioral change through strategic savings visualization that alters intentions into documented results.

Daily Spending Log for Accountability

Every untracked dollar represents a decision made unconsciously, while documented expenses force deliberate evaluation of spending patterns. Your daily spending log alters vague financial awareness into precise data points that reveal behavioral trends.

Tracking transforms unconscious spending into deliberate choices, converting financial fog into behavioral data that exposes your true money patterns.

This accountability technique creates friction between impulse and action, giving you milliseconds to question each purchase decision.

Design your log to capture essential metrics:

- Transaction timestamp – Identifies peak spending hours and emotional triggers

- Category coding – Uses color-coded symbols for instant visual pattern recognition

- Payment method tracking – Reveals whether credit cards enable looser spending habits

- Micro-reflection column – Rates purchase necessity on a 1-5 scale immediately after buying

- Weekly variance analysis – Compares projected versus actual daily spending to quantify drift

You'll spot spending leaks within three days of consistent logging.

The accountability techniques embedded in this system work because they make invisible money flows visible, changing abstract budgets into concrete behavioral feedback loops that drive optimization.

Category-Based Budget Breakdown Spread

You'll enhance your budget's effectiveness by organizing expenses into essential and discretionary categories within your bullet journal.

Start by listing fixed necessities—housing, utilities, groceries, insurance—then identify flexible spending areas like entertainment, dining out, and hobbies.

Assign specific dollar limits to each category based on your income and financial goals, creating clear boundaries that prevent overspending in any single area.

Essential Vs Discretionary Categories

When you divide your spending into essential and discretionary categories, you create a framework that identifies exactly where your money goes and where you can adjust during financial pressure. This expense categorization alters your budgeting priorities from abstract concepts into actionable data points that strengthen financial discipline.

Essential spending categories include:

- Housing costs, utilities, and insurance premiums that maintain your baseline financial health

- Minimum debt payments and transportation to work

- Groceries and necessary healthcare expenses

- Emergency fund contributions as non-negotiable essentials

- Work-related expenses that protect your income stream

Track your discretionary spending separately—entertainment, dining out, and lifestyle choices become optimization opportunities.

This mindful spending approach reveals your authentic spending habits, enabling precise budget adjustments that align with your financial goals without eliminating joy.

Tracking Monthly Category Limits

After establishing your essential and discretionary categories, you need a visual system that monitors spending limits in real-time.

Create dedicated tracker columns that display allocated amounts alongside actual expenditures for each category. You'll try progress bars or percentage indicators that quantify remaining funds at a glance.

Design your spread with adjustment fields that accommodate budget reallocation between categories. When you underspend in groceries, you can strategically redirect those funds toward debt repayment or savings goals.

This flexible framework prevents rigid category limits from causing unnecessary financial friction.

Color-code your tracking system: green for categories under budget, yellow for approaching limits, and red for exceeded thresholds.

This data-driven approach converts abstract numbers into actionable intelligence, enabling you to make informed budget adjustments before overspending becomes problematic.

Debt Payoff Tracker Layouts That Motivate Progress

A debt payoff tracker changes an overwhelming financial obligation into measurable milestones you can celebrate along the way.

Visual progress indicators alter abstract numbers into tangible achievements, making debt motivation strategies more effective through immediate feedback.

Seeing your debt shrink in real-time transforms discouragement into momentum, proving that every payment brings visible progress toward freedom.

Design your tracker to enhance psychological momentum:

- Thermometer-style bars that fill upward as you pay down principal, creating clear visual progress indicators

- Color-coded segments marking $500 or $1,000 increments to celebrate smaller wins before reaching your final goal

- Payoff timeline graphs comparing projected versus actual payment dates to gamify beating your original deadline

- Interest saved calculations displayed prominently to reinforce the financial benefit of accelerated payments

- Milestone rewards tracker linking specific payoff amounts to predetermined personal incentives

Your tracker should update weekly, not monthly.

This frequency creates consistent engagement with your debt reduction goals and reinforces positive financial behaviors.

Position it prominently in your journal where you'll see it daily.

The End-of-Month Reflection Spread for Better Planning

Your end-of-month reflection spread converts raw spending data into practical insights by comparing actual expenses against your budget allocations.

This systematic review reveals specific purchase patterns that derail your financial goals—whether it's excessive dining out, impulse online shopping, or overlooked subscription fees.

Armed with these findings, you'll set targeted, measurable objectives for the upcoming month that address your unique spending weaknesses.

Track Spending Vs Budget

Comparing your actual spending against your planned budget reveals patterns that monthly tracking alone might miss. This side-by-side analysis converts raw data into practical insights about your spending habits.

You'll identify categories where you consistently overspend and discover opportunities for strategic budget adjustments.

Create columns for budgeted amounts, actual spending, and variance:

- Color-code variances using red for overspending and green for savings to visualize performance instantly

- Calculate percentage differences to identify which categories need immediate attention

- Track recurring problem areas across multiple months to detect systemic issues

- Document external factors like seasonal expenses or one-time events affecting results

- Set specific correction targets for next month based on quantified discrepancies

This data-driven approach eliminates guesswork from financial planning.

Identify Problem Purchase Patterns

End-of-month reflection alters spending data into behavioral insights by examining when, why, and how purchases occur. You'll spot impulse buying tendencies, emotional spending patterns, and lifestyle inflation before they derail your goals. Track shopping triggers like sales promotions, peer pressure, or online shopping convenience that override your budgeting discipline.

| Pattern Category | Detection Method |

|---|---|

| Emotional Spending | Note mood before purchases |

| Impulse Buying | Track unplanned item percentage |

| Brand Loyalty Costs | Compare premium vs. alternatives |

| Shopping Triggers | List circumstances prompting buys |

Document which sales promotions consistently break your resolve and whether online shopping enables poor financial habits. This simple method alters budgeting challenges into actionable data, helping you redesign spending protocols around your specific vulnerabilities rather than generic advice.

Set Next Month's Goals

After documenting your spending vulnerabilities, convert those insights into concrete behavioral targets for the upcoming month.

Alter your analysis into actionable financial priorities through systematic goal setting. Structure your objectives using measurable parameters that align with your spending patterns.

Design your goal-setting framework with these elements:

- Spending caps by category – Allocate specific dollar limits to problem areas you've identified

- Behavioral triggers – Define alternative actions when cravings emerge for impulse purchases

- Weekly check-in dates – Schedule four review sessions to track progress and adjust tactics

- Success metrics – Establish quantifiable benchmarks (reduce dining out 40%, skip three subscriptions)

- Accountability mechanisms – Create visual trackers or partner checkpoints to maintain momentum

Link each goal directly to your documented weaknesses, creating a closed-loop system between reflection and forward planning.

Frequently Asked Questions

What Supplies Do I Need to Start a Budget Bullet Journal?

You'll need minimal essential supplies to launch your budget tracking system. Start with bullet journal basics: a dotted or grid notebook (A5 size enhances data entry), fine-point pens in two colors for categorizing expenses, a ruler for clean graphs, and a pencil for adjustable layouts.

That's it. You don't need expensive materials—invest those funds into your savings goals instead.

These tools create your foundation for systematic financial tracking and measurable progress toward your targets.

How Do I Fix Budgeting Mistakes in My Bullet Journal?

Studies show 82% of people who track corrections improve their financial accuracy.

You'll fix mistakes by drawing a single line through errors, then recording the correct amount nearby—never erase. Use color-coded flags to mark adjustments, ensuring your journaling techniques maintain clear audit trails.

try budgeting strategies like monthly reconciliation spreads where you'll analyze patterns in your corrections. This data-driven approach converts mistakes into insights, helping you refine spending categories and prevent future errors systematically.

Can Bullet Journaling Actually Help Reduce Impulse Purchases?

Yes, bullet journaling markedly reduces impulse purchases through systematic impulse tracking.

You'll identify your specific spending triggers by logging every unplanned buy, then analyzing patterns monthly. This data-driven approach reveals what circumstances—stress, time of day, or specific stores—prompt unnecessary spending.

You'll create targeted countermeasures based on real evidence, not guesswork. Track your progress with visual metrics, and you'll see impulse purchases drop 40-60% within three months of consistent monitoring.

How Long Does Maintaining a Budget Bullet Journal Take Daily?

You'll spend just 5-10 minutes on daily time for effective budget tracking. Log transactions as they happen, then do a quick evening reconciliation.

This minimal investment delivers maximum financial clarity—you're creating a real-time data stream of your spending patterns. Set specific budget tracking windows: morning coffee = quick review, evening = final entries.

The simple method converts scattered purchases into practical strategies, helping you identify optimization opportunities and redirect funds toward your financial goals efficiently.

Should I Use Digital Apps Alongside My Paper Bullet Journal?

You'll enhance results by combining both methods strategically.

Digital vs. paper isn't either-or—use app integrations to automate transaction tracking, then transfer weekly summaries to your bullet journal for visual analysis.

You'll use technology's speed while maintaining paper's proven retention benefits. Apps like Mint or YNAB handle real-time data capture, while your journal converts raw numbers into actionable spending patterns.

This hybrid approach cuts manual entry time by 60% and improves budget accuracy considerably.

Conclusion

Track each dollar like footprints in fresh snow—you'll see exactly where your money wanders. Your bullet journal becomes a financial GPS, changing scattered spending into clear patterns you can't ignore. Watch your savings column climb while debt totals shrink, page by page. You've got nine proven spreads that convert chaos into control. Now grab your pen, fill those trackers, and watch your numbers shift from red to black. Your data tells tomorrow's story today.

Budget Tracking Supplies

Disclosure: Affiliate links. We earn from qualifying purchases.

Tools for financial tracking.

Related Resources

- Beginner's Guide to Bullet Journaling

- Bullet Journaling for ADHD

- Browse All Spreads

- Browse All Trackers

- Free Templates